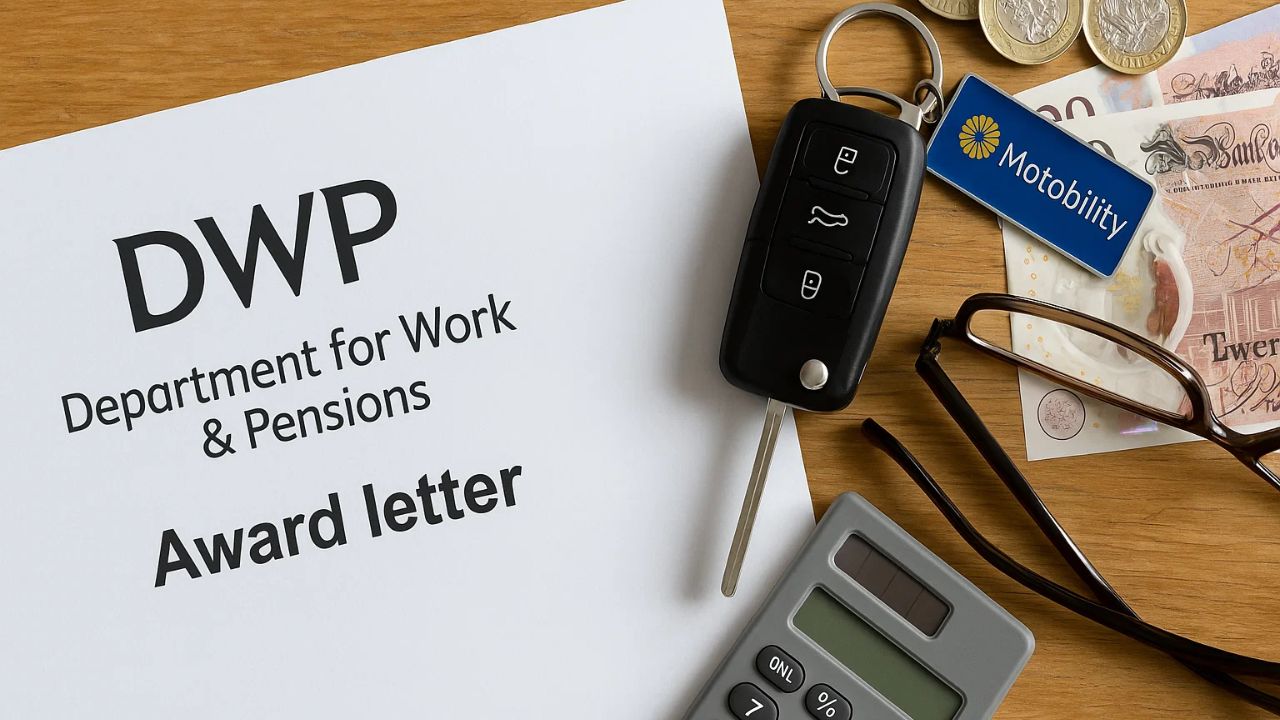

The Motability Scheme, a lifeline for hundreds of thousands of disabled people across the UK, is set to undergo significant changes that could cost users hundreds of pounds more. Announced as part of the Government’s latest budget, a new tax change means that from July 2026, Motability vehicles will no longer be fully exempt from VAT (Value Added Tax) and Insurance Premium Tax (IPT). These changes are expected to increase upfront costs for claimants by over £400, raising serious concerns for current and future scheme users.

With many disabled individuals relying on Motability to stay mobile and independent, understanding what these changes mean is vital. Here’s everything you need to know about the upcoming updates, who will be affected, and how it may impact your finances and mobility options.

Table of Contents

What Is the Motability Scheme?

The Motability Scheme allows eligible disabled people to lease a new car, scooter, or powered wheelchair using their mobility allowance provided through benefits such as:

- Personal Independence Payment (PIP)

- Disability Living Allowance (DLA)

- Armed Forces Independence Payment (AFIP)

- War Pensioners’ Mobility Supplement (WPMS)

Instead of receiving the mobility part of their benefit directly, claimants can exchange it for a fully serviced lease vehicle, which includes insurance, maintenance, breakdown cover, and tyre replacement.

As of 2025, more than 650,000 people across the UK are using the scheme.

What Is Changing from July 2026?

Currently, most costs related to the Motability Scheme are exempt from VAT and IPT, which significantly reduces the overall cost to the user. However, in the Government’s Autumn Budget, a policy shift was announced:

- Advance payments made towards Motability vehicles will now be subject to VAT.

- Insurance elements within the lease agreement will also be subject to Insurance Premium Tax (IPT).

These changes will come into effect from 1st July 2026. It is expected that upfront payments could rise by £400 or more, depending on the vehicle selected.

Why Has the Government Made This Change?

According to Treasury documents, the aim is to bring tax treatment of Motability leases more in line with similar private leasing options. However, many disability rights groups have criticised the move, calling it unfair and damaging to some of society’s most vulnerable.

Disability Rights UK has called the policy “punitive” and “confusing,” questioning the logic of taxing a scheme designed solely to support people with mobility challenges.

Motability’s Response: Will the Scheme Still Be Affordable?

Motability Operations, the company that runs the scheme, has issued a public statement confirming the tax changes. However, they have reassured customers that they are working to minimise the financial impact:

- They are exploring options to absorb part of the cost to prevent a full pass-through to customers.

- No immediate changes will be made to existing contracts or new leases before July 2026.

- Eligibility criteria remain unchanged.

The organisation has also stated it will continue to provide grants and support for those who cannot afford increased advance payments.

Who Will Be Affected Most?

Those most likely to feel the impact include:

- New applicants joining the scheme after July 2026.

- Current users who will need to renew or replace their vehicle after the tax changes come into effect.

- Those choosing higher-spec or larger vehicles that already come with higher advance payments.

What Should Claimants Do Now?

While no immediate action is needed, claimants should be aware of the upcoming changes and plan ahead. Here are a few key points:

- Leases starting before July 2026 will not be affected.

- Review your vehicle options closer to your renewal date to keep costs manageable.

- Keep an eye on Motability’s official updates for any future support or subsidies.

- Consider applying for grants if affordability becomes an issue.

Key Points at a Glance

| Change | Description | When? |

|---|---|---|

| VAT on Advance Payments | Will be added to most vehicle upfront costs | From July 2026 |

| Insurance Premium Tax | Now applicable to lease insurance costs | From July 2026 |

| Eligibility | No change to benefit-linked eligibility | No change |

| Support Options | Motability will still offer grants and help | Ongoing |

The Government’s decision to impose VAT and Insurance Premium Tax on the Motability Scheme from July 2026 will mark a major shift in how the scheme is funded and used. For the many disabled individuals and families relying on it for independence, it is essential to stay informed, budget ahead, and explore the available support through Motability.

Motability has promised continued transparency and assistance to users as these changes approach. Until then, current leaseholders are unaffected and can continue to use the scheme as usual.

Stay updated by visiting the official Motability website and following reputable news sources for the latest information.